The future of 2290 online filing and how it's changing tax prep for truckers

The future of 2290 online filing and how it's changing tax prep for truckers

Blog Article

The Internet is a great place to look for good deals on just about anything. This includes muscle supplements, from beginners using protein, to the advanced lifters using prohormones . When looking online it is important to find a secure site that has quality products that will give you results. There are thousands of sites that are selling supplements and it can be difficult choice to pick which site you can trust. On top of that one must try to find safe and effective supplements to use.

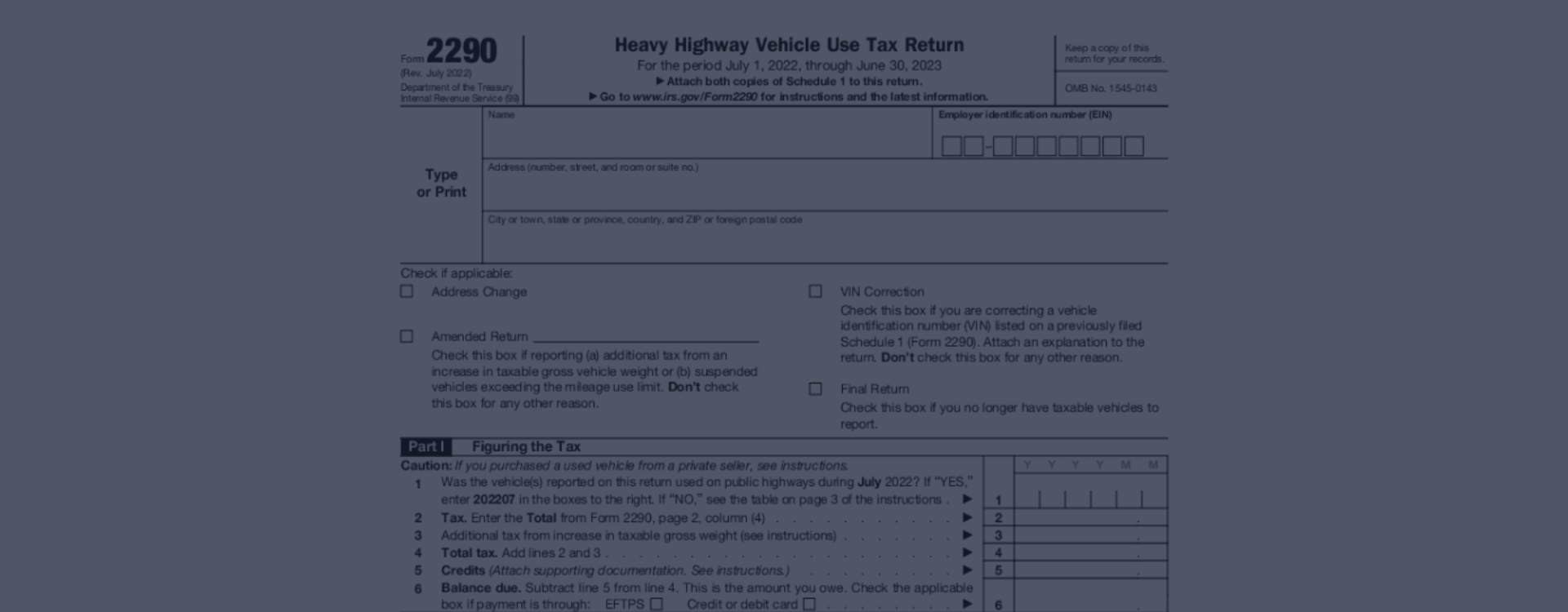

The best method for doing this is through the use of e-forms. These are now easily available on relevant websites. One such form is the 2290. Filling out the form is essential if you operate trucks on public roads. To ensure a quick filing of the necessary forms, there is now a facility for form 2290 tax form electronic filing.

Among these Form 2290 online choices filing through a company makes the most sense. This option allows you to transfer work to the firm you hire. Of course, reasonable fees will apply, but you get the most out of your money since they will complete the legwork while you just wait for results.

Many of you have heard of Sec 179 depreciation. That is a special rule by the IRS that says you can take the whole cost of such an item in the year you purchased it. That is ONLY allowed if you are making a profit, and if you bought it new (not used). For the example given, the entire $700 would be taken the year it was purchased.

A major concern many people have is that they worry about their tax return disappearing into the black hole of cyber-space never to been seen or heard from again until they receive a threatening letter from the IRS heavy vehicle tax informing them that they have not filed a return. There is no need for fear, usually within 24 hours and almost never more then 48 hours the IRS sends a message to the transmitter (your accountant) either accepting the return or telling them that there are errors which must be corrected. In either case the process is transparent and foolproof ensuring that every return is accounted for.

Keep in mind that most people spend a few seconds on a page before deciding if they're interested. It's best to keep the page clutter-free and easy to navigate. Include a picture and pricing of each item (in the form of a gallery), and then create another page that goes into detail that includes a product description and specs with the option to 2290 form instructions purchase-similar to major retail sites.

Filing state tax is something every one has to whether the person likes to do it or not. It is advisable to get one early to be familiar with how it works so there won't be any problems later on.